Cryptomining is at its peak, being one of the most profitable and accessible niches for crypto enthusiasts today. This is partly due to the high availability of equipment (thanks to ASICS), as well as free access to a variety of technologies and methods that can be used and combined with each other to maximize computing power.

One of the most important points is the exact location where you are going to mine BTC. Indeed, the initial choice of location can significantly affect your overall budget. This is why miners tend to change countries to relocate their operations.

How can choosing the right location help you save your budget, and which options should you consider first? Let’s find out right now.

How does crypto mining work?

But first, a quick overview of cryptomining basics.

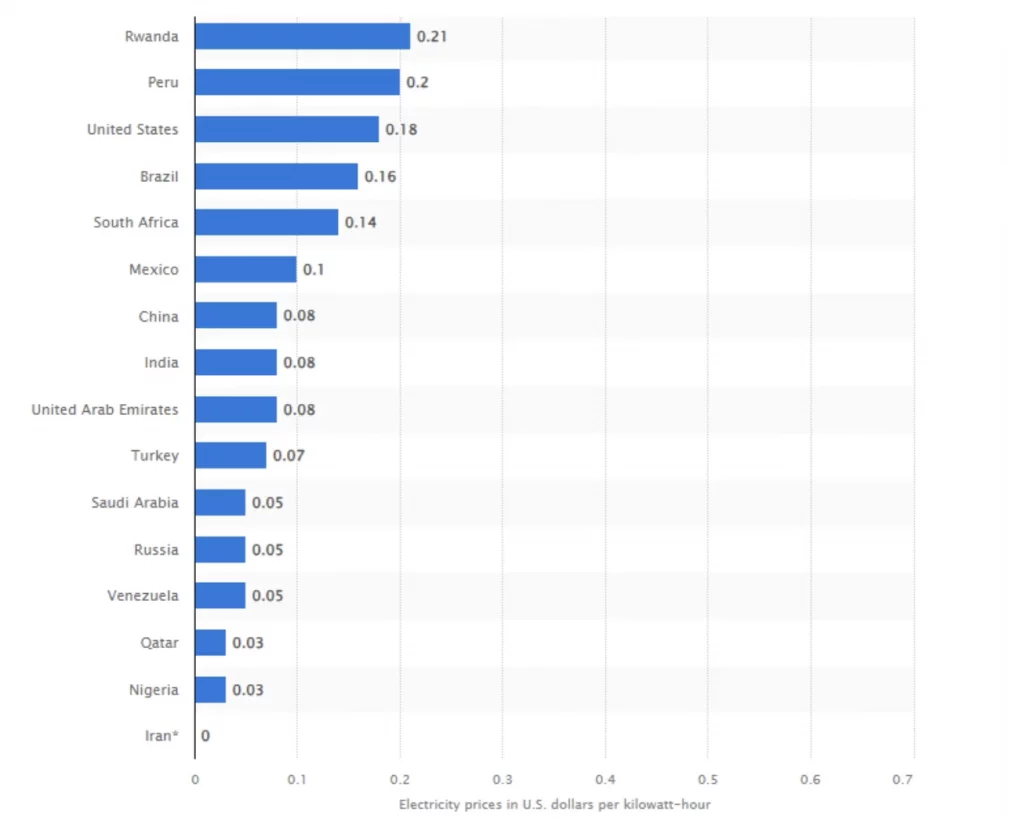

In general, this process involves using a proof-of-work system with ASIC hardware to solve complex mathematical problems. The main requirement here is a stable power consumption. That’s why electricity costs are a major concern, which forces rigs relocation to regions with more affordable utility rates for businesses and cooler climates.

However, high power consumption and its relatively high price are one thing. In fact, there are other external factors that can become serious obstacles to generating income from this activity. So, here are the ones you need to pay attention to the most.

Regulatory Environment

The first factor related to location is local legislation. Yes, given that coins like BTC have been around for many years, you can use them to pay for gas in some places.

At the same time, the concept and technology used to implement crypto payments is still relatively new on a global scale, so some regions try to regulate them more intensively than others. Against this background, the lack of international standardized rules has led regions like China to completely ban crypto operations, regardless of their purpose.

For similar reasons, Iran, Colombia, and Taiwan have partially banned cryptomining and trading operations. This is important to consider when looking for a place to place your equipment.

Climate

A less obvious factor is the weather. Farms tend to get very hot due to the high energy consumption caused by the high computing power.

This is why quality cooling is one of the first technology priorities. This means that cooler climates are better for consistent, long-term operations, and therefore should be considered

as an optimal option for relocation from too hot, dry places.

For example, Iceland and Norway offer the benefits of natural cooling due to their cooler climates, reducing the need for energy-intensive cooling solutions.

Infrastructural & political situation

In contrast to areas where cryptocurrency transactions are either banned or heavily regulated, there are regions that actively encourage crypto communities and stimulate their growth. These include the US, Switzerland, Singapore, and the UAE.

To summarize, which regions should be considered based on the above? Let’s dive deeper into the crypto market situation for each of the previously described options today.

|

Country |

Electricity cost |

Infrastructure |

Climate |

Mining cost per 1 BTC |

|

Algeria |

$0.03–$0.05 USD/KWH |

Developing |

Hot, arid |

~$4,000 |

|

Ethiopia |

$0.01–$0.03 USD/KWH |

Developing |

Tropical |

~$2,000 |

|

Kazakhstan |

$0.01–$0.03 USD/KWH |

Established |

Cold, arid |

~$8,000 |

|

USA |

$0.05–$0.10 USD/KWH |

Advanced |

Varies by region |

~$11,000–12,000 |

|

Georgia |

$0.075–$0.11 USD/KWH |

Developing |

Mild, temperate |

~$ |

Best Countries to Mine Bitcoin

So, let’s check out the best locations. You can also see the summary in the table above and find out more details below.

Algeria

Algeria is widely known as one of the most successful regions in Africa for mining. Thanks to ultra-low electricity prices and a cool climate, Algerian crypto enthusiasts were able to obtain 10% of the entire BTC share in June 2022. At the same time, local legislation regarding cryptocurrencies is only just being formed, which creates very favorable conditions for stable activity in the near future.

In Algeria, utility rates for business are low:

- ~ $0.039 per kWh for household

- ~ $0.033 per kWh for businesses

- you also must spend on energy ~ $4,183 per BTC.

However, Bitcoin’s market value far exceeds these expenses, so locating in Algeria remains a highly profitable solution. Moreover, the region’s rich solar energy potential opens up great opportunities for even more eco-friendly and cheaper operations.

Pros and cons of Bitcoin mining in Algeria

Pros:

- Low energy costs

- Optimal climate

- High profitability

Cons:

- Vague regulatory environment

- Fossil fuel dependence

Bitcoin Mining Opportunities and Risks in Algeria

Algeria relies on fossil fuels to keep electricity rates affordable for households and businesses. However, its renewable energy potential is quite promising. It is located predominantly in the desert, where solar radiation can produce up to 2,100 kilowatts per hour. This could have a positive impact on the local power grid and optimize your expenses in the future.

However, today, renewable energy production remains limited: only 448 MW of solar, 228 MW of hydropower, and 10 MW of wind are produced annually. While these numbers explain the need for scaling, they also indirectly indicate that possible government initiatives in this direction will also provoke stricter regulation.

In short, while the favorable conditions in Algeria today make it an optimal choice for your needs, you still should update the knowledge of possible legislative changes regarding the green solutions being deployed.

Ethiopia

Ethiopia’s electricity grid is primarily powered by hydropower, which makes up about 90% of its energy mix; wind and thermal sources contribute only 8% and 2%. However, despite its limited renewable energy capabilities, the country can be a serious contender in our race due to its low electricity tariffs.

According to Visual Capitalist, miners in Ethiopia spend about $7,169 to produce one BTC, positioning the nation as a cost-effective option in the global market.

Moreover, the Ethiopian government has demonstrated its cryptocurrency-friendliness – in June 2022, the central bank introduced guidelines requiring crypto operators to register with the Information Network Security Administration. This initiative says a lot about Ethiopia’s focus on digital currency innovation.

Pros and Cons of Bitcoin Mining in Ethiopia

Pros:

- Low electricity costs

- Government support

Cons:

- Regulatory uncertainty

- Possible infrastructure challenges

- Political instability

Bitcoin Mining Opportunities in Ethiopia

Ethiopia’s stable regulatory environment and low utility rates create favorable conditions for BTC mining. Thus, investors who are willing to build the necessary infrastructure can reap considerable profits there.

Moreover, it is rich in primary renewable energy sources, which provides a favorable environment for reducing operating costs and increasing long-term viability.

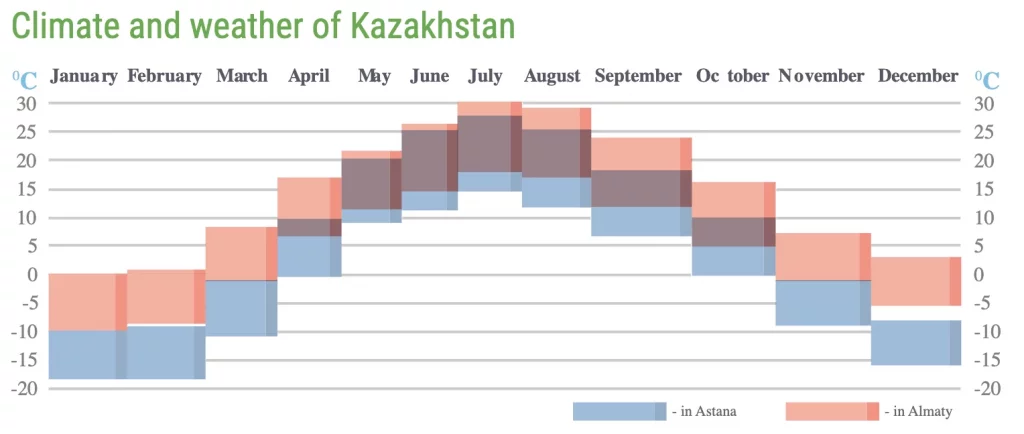

Kazakhstan

Kazakhstan has been a well-known hub for miners since 2021, especially after the failure of China’s cryptocurrency legislation. Thanks to a mining-friendly regulatory environment, in Kazakhstan, you can produce BTC at an average cost of around $8,762 per coin.

While in 2022, it suffered from power outages and regulations due to Bitcoin’s high energy requirements, today, it remains a top destination. With government policies capping tariffs at $0.02 to $0.03 per kWh, it creates a well-regulated and safe environment.

In addition, Kazakhstan’s cold climate, where winter temperatures in the north drop to -20°C, naturally helps keep equipment cool.

Pros and Cons of Bitcoin Mining in Kazakhstan

Pros:

- Low utility rates

- Mature industry

- Government incentives

Cons:

- Environmental issues

- Regulatory changes

- Infrastructure strain

Bitcoin Mining Opportunities and Risks in Kazakhstan

The cryptomining sector in Kazakhstan has seen major upheavals. China’s 2021 ban has seen the lion’s share of operations move to Kazakhstan, leading to a massive 8% increase in electricity demand and subsequent power shortages. In response, the government introduced energy regulation and raised electricity rates.

In 2024, authorities tightened regulations, shutting down 36 unlicensed crypto exchanges and confiscating assets worth about $4.8 million. Additionally, new legislation forces miners to sell 75% of their digital assets through registered exchanges to prevent tax evasion. These cases have left people feeling uncertain about the future impact on their operations.

The USA

The United States has positioned itself as a global hub for BTC mining. In 2023, Americans accounted for over 38% of the network’s total hashrate, further highlighting the its dominance (despite the average mining cost being around $21,089 per BTC).

However, there are several factors that contribute to this success – firstly, many US states have adopted crypto-friendly regulations stimulating innovation and attracting new investment. For example, Texas stands out as a leading hub (as it accounts for over 28% of the country’s hashrate) due to its favorable regulatory environment and abundance of green energy solutions from wind and solar. Second, the USA offers top-tier infrastructure and resources. Stable internet connectivity, high-performance data centers, and professional hosting services like EZ Blockchain give Americans the tools they need to remain competitive in the constantly growing crypto market.

Pros and Cons of Bitcoin Mining in the US

Pros:

- Stable regulatory environment

- Renewable energy opportunities

- Advanced infrastructure

Cons:

- Higher utility rates

- Environmental scrutiny

- Regulatory compliance

Bitcoin Mining Opportunities and Risks in the US

While the cost of BTC mining in the US is higher than in Kazakhstan and Georgia, the US still offers additional opportunities due to its political stability, established regulations, and of course, thriving infrastructure. For example, innovative companies such as EZ Blockchain actively reduce operational expenses by implementing immersion cooling systems, which enhance equipment efficiency and duration of correct operation.

Additionally, EZ Blockchain utilizes natural gas from oil fields that would otherwise be wasted to provide electricity to the mining industry, effectively cutting overhead expenses and supporting eco-friendly operations.

Georgia

Georgia offers BTC mining costs of around $13,143 per BTC. While this figure is higher compared to some other regions such as Algeria or Kazakhstan, it remains an attractive destination – especially for people willing to introduce sustainable solutions. Incidentally, only 2% of Georgia’s energy comes from fossil fuels, while around 70% is generated by hydropower.

On top of that, it’s worth noting the competitive electricity rates ranging from $0.075 to $0.11 per kWh and a business-friendly environment.

In general, while there are no standardized rules, the National Bank of Georgia controls the taxation of cryptocurrencies and requires companies to obtain the appropriate licenses before starting operations. Thus, thanks to friendly government policies and a variety of renewable energy sources, Georgia continues to be one of the best places in the world for the aforementioned activities.

Pros and Cons of Bitcoin Mining in Georgia

Pros:

- Low electricity prices

- Favorable tax policies

- Government friendliness

Cons:

- Infrastructure limitations

- Regulatory ambiguity

- Environmental impact

Bitcoin Mining Opportunities and Risks in Georgia

Georgia has emerged as a prominent cryptomining region, thanks to its favorable regulatory environment and rich energy resources. The government imposes minimal restrictions on crypto activities, offering a 0% tax rate on trading.

To further support this growing industry, Georgia plans to boost its hydropower capacity. The Georgian State Electrosystem’s Ten-Year Network Development Plan for 2021-2031 aims to more than double the installed capacity from 4,533 MW to 10,396 MW by 2031.

This expansion will likely provide more affordable and sustainable energy, minimizing operating costs in the sector.

The Cost To Mine 1 Bitcoin By Country

To sum up and conclude the article, we will provide an additional estimate of the upcoming expenses that you will have to invest in mining 1 BTC in both the above-mentioned and other countries.

| Country | Cost to mine a Bitcoin (USD) |

| Lebanon | $266 |

| Iran | $532 |

| Syria | $1,330 |

| Ethiopia | $1,556 |

| Sudan | $1,930 |

| Libya | $1,950 |

| Kyrgyzstan | $1,980 |

| Angola | $2,050 |

| Zimbabwe | $2,100 |

| Bhutan | $4,256 |

| United States | $4,758 |

| China | $3,172 |

| Argentina | $9,000 |

| Venezuela | $12,000 |

| Paraguay | $14,630 |

| Ecuador | $25,500 |

| Brazil | $45,490 |

| Germany | $8,060 |

| Italy | $208,560 |

Bottom Line

Cryptomining, while completely accessible and easy to learn at this stage, is still a very niche market, full of nuances and unique features that should not be neglected. One of these features is the thoughtful choice of the location.

Therefore, feel free to contact EZ Blockchain for a personalized consultation, location-based profitability calculation, and launching and deploying your mining operations in the most cost-effective country available.