The concept of mining, which involves obtaining cryptocurrency through complex, resource-intensive calculations and verifying and creating transactions in the blockchain, is metaphorically reminiscent of extracting precious metals from the ground because in both cases, all the tasks associated with them are systematized from start to finish.

At the same time, when cryptocurrency mining is still a rather complex process to understand, it is much easier to imagine how gold mining occurs. That is why we decided to compare these two processes to highlight their similarities and differences – perhaps this will help you make the right choice regarding discovering new income sources.

The Common Ground

Proof-of-Work

Bitcoin and gold mining are similar in their goal – extracting value from limited resources (computing in the former case, precious metals in the latter). Let’s look at an example – gold miners move huge volumes of rock in search of nuggets, while Bitcoin miners solve complex computational problems to verify transactions and generate new coins. This process, also known as proof of work, also requires significant effort and resources in the latter case, which is very similar to the physical process of extracting the yellow metal.

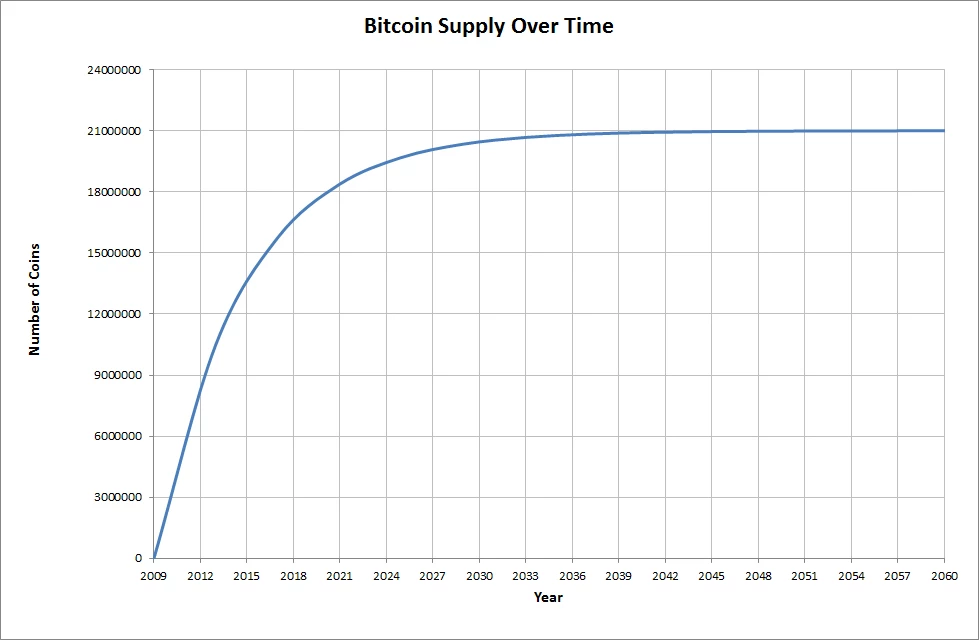

Finite Resources

Also, aspects such as increased market demand and deficit should be attributed to the general characteristics, because they determine the value of both gold and BTC. The yellow metal maintains its value due to the limited supply, and bitcoin maintains its external market value due to the fixed emission of 21 million coins. Thus, the limited quantity of both determines the similarity between these two assets.

Resource Dependency

The profitability of these two sectors is also determined by the availability of resources used to obtain them. Crypto mining requires powerful computing equipment and relatively cheap electricity, while gold extraction from the earth and rocks involves finding deposits and installing the appropriate infrastructure. Ultimately, the high cost of production in these two cases also draws parallels between them.

Market Volatility

Both gold mining and crypto mining regularly face market fluctuations. In particular, the foreign market price of gold is influenced by a number of economic factors, as well as geopolitics and market sentiment. Likewise, the price of Bitcoin is largely dependent on news about the adoption of regulatory legislation, the emergence of innovative technologies for the production of high-performance computing equipment, the development of new computing algorithms, and investment trends. Actually, all of these aspects inevitably lead to significant fluctuations in the prices of these assets.

Beta of Mining Stocks

The stocks of companies involved in BTC and gold mining are also similar in many ways. The fact is that they are often speculative, as investors evaluate the potential for future growth in the value of the mined asset when making their decisions. Likewise, both types of stocks exhibit a higher beta (meaning volatility) compared to the underlying asset and are generally sensitive to operating costs – in crypto mining, these are the expenses on electricity and equipment, and in the second case, the expenses required to hire personnel, buy fuel, and purchase or rent equipment.

Regulatory Impact

Finally, both of these industries are subject to changes in legislation. As you may have noticed, crypto mining is very dependent on cryptocurrency regulation and energy policy (both in individual regions and around the world), and gold mining is dependent on environmental regulations and subsoil use laws. From this, we can logically conclude that any changes in these areas will affect the business models of companies involved in either the first or second type of activity.

Diverging Paths

Physical vs. Digital

Bitcoin mining takes place in the digital plane and involves high computing power and significant energy consumption. However, the physical processing of any materials is not typical for this process. Conversely, gold mining involves extracting ore from the ground using drilling and blasting equipment. Hence, the need for significant labor costs on the part of people and the need to process physical materials. These specifics determine the fundamental difference between these two processes.

Maturity of the Market

Gold mining is an industry that has been around for a long time and has a history of thousands of years. As such, it is now regulated by strict standards and guarantees predictable profits, which attracts long-term investment and is considered one of the least risky. On the contrary, Bitcoin mining is a relatively new and rapidly developing industry with increased market volatility. As a result, miners face regulatory uncertainty and environmental challenges, which expose them to some risks that are not typical for gold mining.

Centralization

Crypto mining is inherently decentralized, with miners’ computing power spread across the globe. At the same time, this scale encourages centralization, giving large players access to cheap electricity and a competitive advantage. In contrast, gold mining is more consolidated, with multinational corporations dominating the market with large investments in exploration, extraction, and processing. This creates a hierarchical structure for the industry and a high entry threshold for new players.

Environmental Impact

Gold mining causes land degradation and often involves deforestation and water pollution due to the toxic substances used in gold mining processes (primarily mercury and cyanide). This provokes a loss of biodiversity and generally leads to long-term damage to ecosystems. Bitcoin mining, on the other hand, does not pollute the soil or water, but it does consume huge amounts of electricity, which can strain the power grid and increase greenhouse gas emissions. However, in the latter case, there is an eco-friendly alternative – renewable energy sources.

Technological Advancements

Innovations in gold mining are aimed primarily at increasing the efficiency of work processes, reducing the costs of their implementation, and their automation, because all this can stabilize prices for the yellow metal. In Bitcoin mining, technical progress is critical since the complexity of calculations is constantly growing, and modern ASIC miners allow those who want to scale to remain competitive and profitable. However, unlike gold mining, in the second case, innovations do not reduce the cost of production but support the possibility of functioning and further development of the industry.

Lifecycle and Depreciation

Bitcoin mining equipment quickly becomes obsolete due to the increasing complexity of calculations. As a result, it requires regular upgrades and new costs associated with it. On the other hand, gold mines have a much longer lifecycle, although their reserves can also be depleted. Bitcoin miners are forced to regularly upgrade their equipment, while gold mining companies deal with resource depletion. Either way, both industries require constant investment, but their assets are radically different.

In Conclusion

In summary, although BTC and gold mining are identical in their pursuit of rare resources and must obey certain economic laws, their methods and role in the markets are significantly different. That is why it is so important to understand the differences in terminology for these two assets to make the right choice in favor of investing in one or the other.